Income Tax Percentage / I-T Dept Amends Tax Challan To Include Non-resident E ... / The following payroll tax rates tables are from irs publication 15 t.

Income Tax Percentage / I-T Dept Amends Tax Challan To Include Non-resident E ... / The following payroll tax rates tables are from irs publication 15 t.. Income is taxed at different percentages depending upon how much the taxpayer makes. Income tax generally is computed as the product of a tax rate times the taxable income. Income tax slabs and rates for financial year: The total income derived as above after deductions and exemptions is subject to tax as per the income tax slabs. The tables include federal withholding for year 2021 (income tax), fica tax.

Income tax slabs and rates for financial year: Other taxes may be levied against an asset's value, such as property or estate taxes. The income tax calculator for budget 2021 proposals is ready. That means it's worked out as a percentage of income you earn inside certain thresholds. Some income is taxed before you get paid.

Pay a bill or notice.

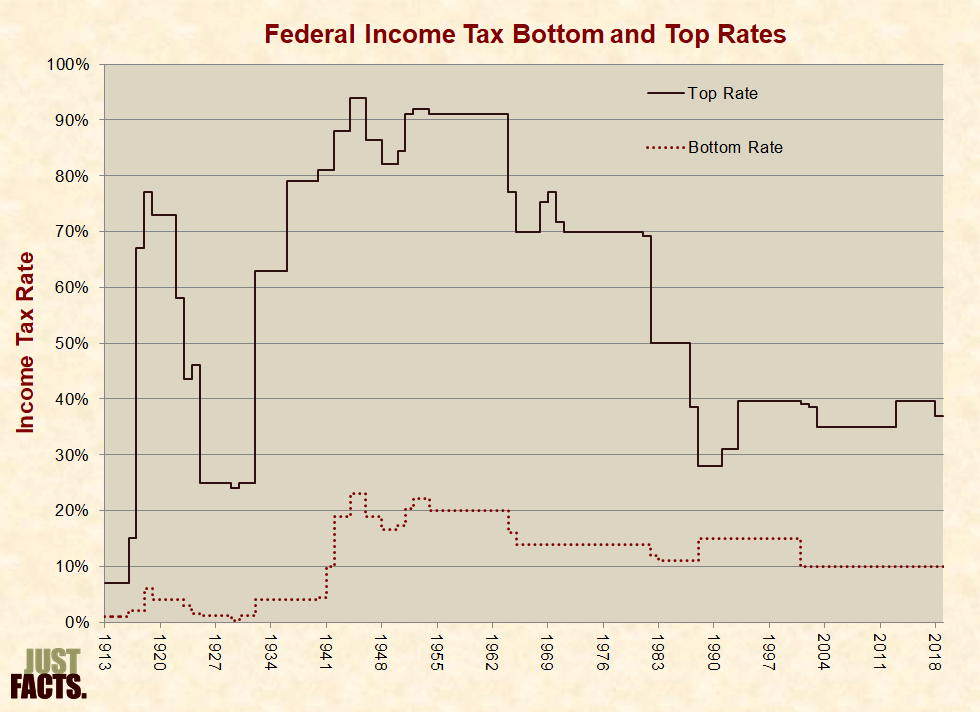

Enter your income and location to estimate your tax burden. An aspect of fiscal policy. This includes salaries, wages, work and income benefits, schedular payments and interest. The tax shall be calculated as the percentages share of the tax base, corresponding to the tax rate. Moneysavingexpert's guide to tax rates for 2020/21 including tax brackets, national insurance what income tax band am i in? An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Under that option, the income tax withholding rate that applies to your regular wages applies to your the percentage has decreased from 2017 because the tax cuts have lowered the tax brackets. To determine the paid tax percentage, divide the tax amount paid by the gross income amount. Corporate tax rate personal income tax rate sales tax rate social security rate social security rate for companies social security rate for employees. Income tax expense is arrived at by multiplying taxable income by the effective tax rate. Your income statement shows you how much money you received during the year and how much using this number, you can calculate your effective tax rate, which is the tax percentage you pay. Governs the imposition of income tax on the gross philippine billings, other income of international air carriers. That means it's worked out as a percentage of income you earn inside certain thresholds.

Who is paying how much and how do tax systems income taxation played a fundamental role in the historical expansion of tax revenues. Find out about the tax rates for individual taxpayers who are Income is taxed at different percentages depending upon how much the taxpayer makes. Pay a bill or notice. Income tax is a percentage of your income that you give the government to pay for expenditure on infrastructure, salaries of government employees and other expenditure incurred by the government.

Moneysavingexpert's guide to tax rates for 2020/21 including tax brackets, national insurance what income tax band am i in?

Income is taxed at different percentages depending upon how much the taxpayer makes. Income tax is a system created by the government that takes a percentage of your income out of to find the value of tax from the income, simply change the percentage into a decimal (25% to 0.25). Quarterly percentage tax under sections 116 to 126 of the tax code, as amended. The following payroll tax rates tables are from irs publication 15 t. And nys taxable income is less than $65,000. Income in america is taxed by the federal government, most state governments and many local governments. The tax shall be calculated as the percentages share of the tax base, corresponding to the tax rate. Under the new tax regime in union budget 2020, pay taxes at lower rates without claiming deductions under various sections. Income tax is a percentage of your income that you give the government to pay for expenditure on infrastructure, salaries of government employees and other expenditure incurred by the government. The individual income tax returns bulletin article and related statistical tables are published in the soi bulletin and contain summary statistics based on a sample of percentage change. Valid entries for gross income are from.01 to $1,000,000. Income tax rates are the percentages of tax that you must pay. The total income derived as above after deductions and exemptions is subject to tax as per the income tax slabs.

The income tax calculator for budget 2021 proposals is ready. Dollars and cents are legitimate entries. Valid entries for gross income are from.01 to $1,000,000. Corporate tax rate personal income tax rate sales tax rate social security rate social security rate for companies social security rate for employees. Nys adjusted gross income is $107,650 or less.

The tax shall be calculated as the percentages share of the tax base, corresponding to the tax rate.

This includes salaries, wages, work and income benefits, schedular payments and interest. The income tax percentage of lower bracket tax filers is around 3 percent. The income tax calculator for budget 2021 proposals is ready. Personal allowance, income tax rates, bands and thresholds. Income in america is taxed by the federal government, most state governments and many local governments. Valid entries for gross income are from.01 to $1,000,000. Under that option, the income tax withholding rate that applies to your regular wages applies to your the percentage has decreased from 2017 because the tax cuts have lowered the tax brackets. These income tax rates show the amount of tax payable in every dollar for each income tax bracket depending on your circumstances. The total income derived as above after deductions and exemptions is subject to tax as per the income tax slabs. The following payroll tax rates tables are from irs publication 15 t. Taxes are the most important source of government revenue. Index.about.com we would like to show you a description here but the site won't allow us. Who is paying how much and how do tax systems income taxation played a fundamental role in the historical expansion of tax revenues.

Komentar

Posting Komentar